Income Analysis Report

The Income Analysis report provides an invoice and receipt-based breakdown of revenue for a given period from both an accrual and cash basis.

Before you begin

The report also lists or takes into account write-offs, discounts and refunds of allocated payments which are either expenses or contra income against the earned revenue. Additionally provides a transaction breakdown of unallocated credit payments and refund of unallocated credit payments for a given period.

The following report sections are displayed in the report:

- Invoices issued

- Sundry invoices issued and claim/batch error write-offs

- Discounts granted for invoices

- Bad debt write-offs

- Refunds of allocated payments

- Receipts allocated to invoice items

- Credit allocated to invoice items

- Refunds of allocated payments

Ancillary Information - totals displayed in this report tally with the related sections

of the following reports for the same date range:

- Invoice Summary

- Invoice Detail

- Allocation Summary

- Allocation Detail

- Income Summary

- Income Analysis Detail

- GST

- Debtors' Reconciliation

Transactions displayed in this report tally with the related sections of the following

reports for same date range:

- Invoice Detail

- Allocation Detail

- Income Analysis Detail

- Invoice Audit Trail

- Receipt Audit Trail

- Refund Audit Trail

- Write-off Audit Trail

About this task

Tip:

If generating a report with more than 3

years of data, export to a CSV file.

Procedure

-

Either:

- Click

- Press Ctrl + P

- Select

- Click

-

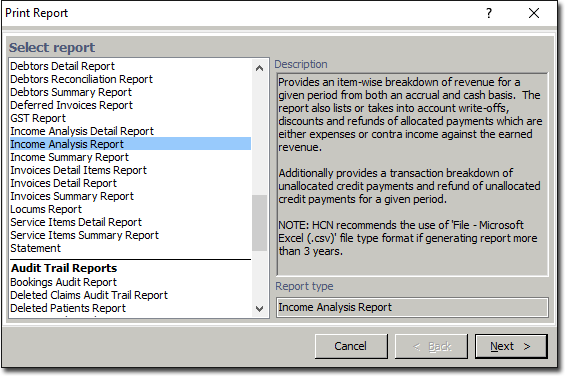

The Print Report window appears.

-

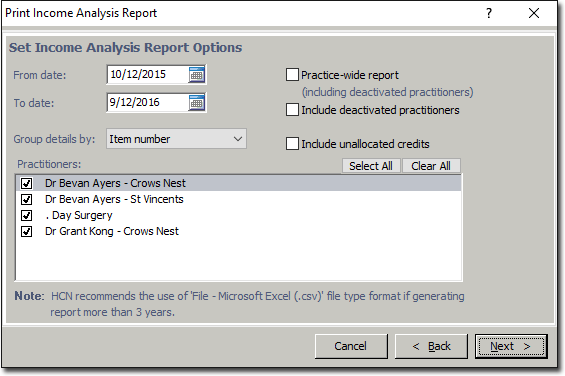

Select Income Analysis Report from the list of reports and click Next The window appears.

- Enter a date range.

- Indicate how you want to group the printed details.

- Indicate other options as desired.

- Indicate which practitioners you want to print data for (all or specific).

- Click Next when you are ready to proceed.