Invoicing For Assistant Items

Before you begin

Procedure

- Create the invoice for the principal provider first. This invoice should consist only of Service Items for the principal provider. Do not add Assistant Service Items to this invoice.

- Submit the principal provider's claim to Medicare. It is advisable that you wait for the claim to be processed completely before invoicing for the assistant, to allow for any rejections that may occur.

-

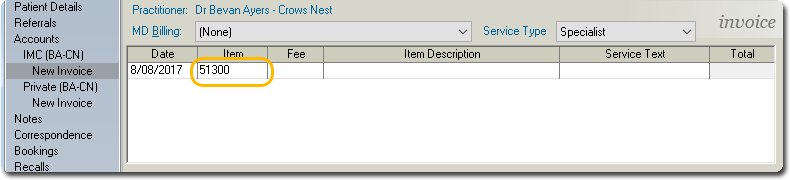

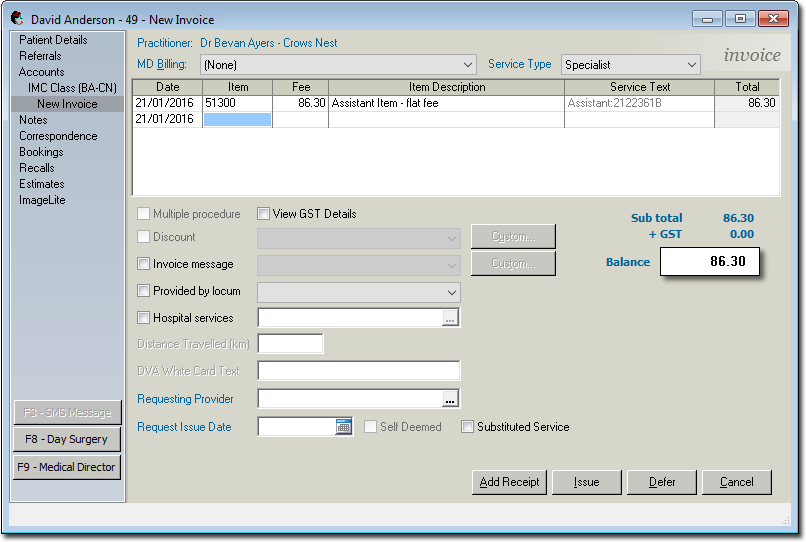

Then, create a new invoice for the Assistant, invoicing for any of the assistant items you configured above (in our example, we have used item 51300).

-

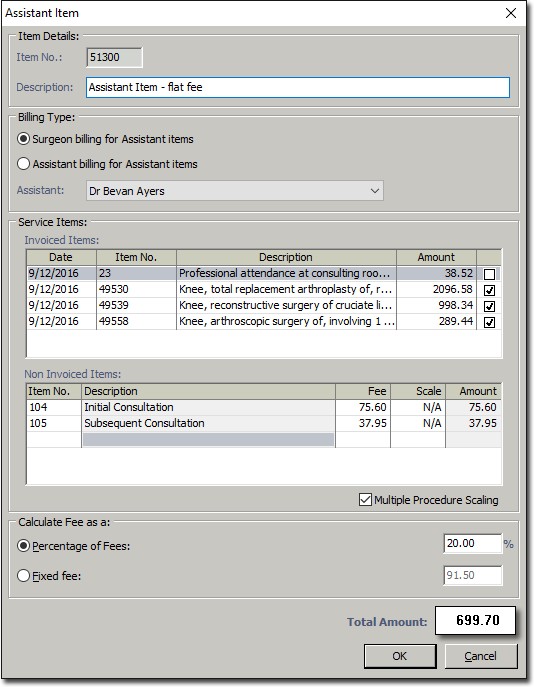

Upon pressing the Tab key, the Assistant Item window appears.

-

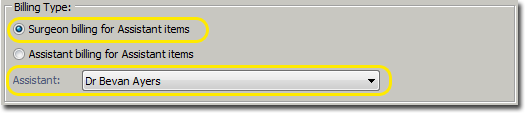

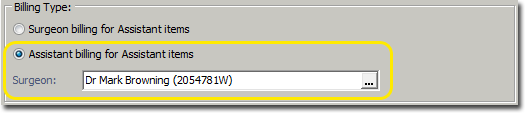

Via the Billing Type section, indicate whether in this instance the Assistant Item is being billed for by;

- A Surgeon, billing for Assistant items on behalf of the Assistant. If you select this option, you must also specify which Assistant the surgeon is billing on behalf of.

- An Assistant, billing for themselves. If you select this option, you must specify the Assistant's surgeon.

- A Surgeon, billing for Assistant items on behalf of the Assistant. If you select this option, you must also specify which Assistant the surgeon is billing on behalf of.

- The Invoiced Items section lists all the Service Items you are invoicing for. You may also list non-invoiced items by entering them in the Non Invoiced Items section. You may want to do this if the fee you want to charge is a percentage of one or more other Service Items.

- If you want to apply Multiple Procedure Scaling for non-invoiced items selected for Assistant Item fee calculation, tick the Multiple Procedure Scaling check box. Note that the Non-Invoiced Items section of this window will display a Fee column and a Scale column when this check box is ticked, and fees will be calculated using Multiple Procedure Scaling for applicable service items.

-

Indicate whether you will charge an overall Fixed Fee or a Percentage of specific Service Items; within the Calculate Fee as a section, select either the Percentage of Fees option, or the Fixed Fee option.

- If you choose the Fixed Fee option, you must specify the fee amount in the field provided. It is recommended that you also indicate which Service Items the fixed fee is associated with. Failure to do so may result in Medicare rejecting the claim.

- If you choose the Percentage of Fees option, you must also specify the percentage rate (e.g. 20%) in the field provided, and then indicate which Service Items you will charge the rate against, by ticking each item's associated fee check box. This option is selected in the example above. Note that if you have added items to the Non Invoiced Items section, it is assumed that each will be considered when your % fee is calculated. If you want to remove an item from the Non Serviced Items section, select the item and click press CTRL + Delete on your keyboard.

-

Click OK. to confirm. You will be returned to the New Invoice window. Note the Assistant Item, along with its fee. Note also the Service Text description - this can be accessed by clicking within the Service Text field and pressing SPACE + ENTER on your keyboard.

-

Click

to issue the invoice. -

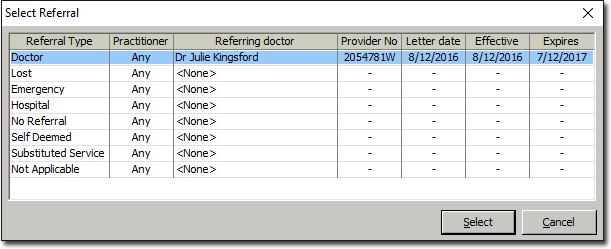

(optional) You may be prompted to select an associated referral.

-

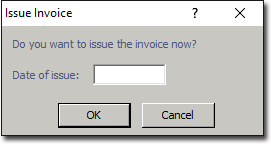

The Issue Invoice window appears. Enter the date on which the invoice was issued, The default is today's date, but you can back-date it if you want.

-

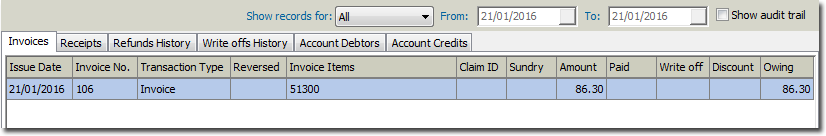

Click OK. You will be prompted to print the invoice. The Invoices tab displays the Assistant Item.