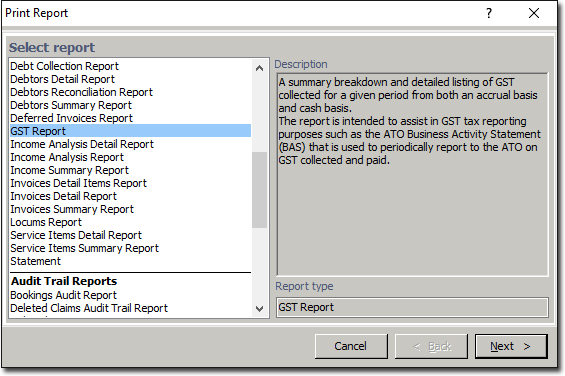

GST Report

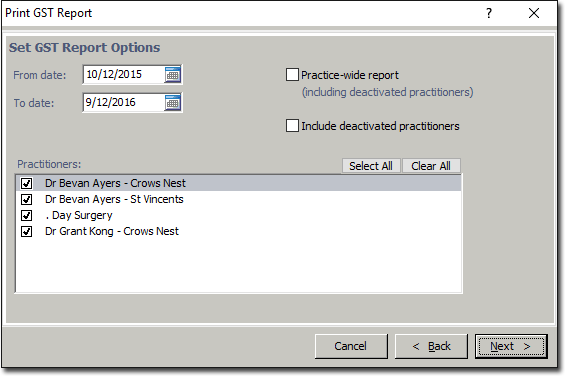

The GST report assists with GST reporting requirements such as the ATO Business Activity Statement (BAS) that is used to periodically report to the ATO on GST collected and paid, and provides a summary of GST collected and earned on an accrued basis and cash basis for a specified period (practice-wide or practitioner-wide).

Before you begin

The GST report is calculated based on date of entry. This means, for example, that a GST-inclusive Tax Invoice generated on 1 July, for a service that was provided on 30 June, will be included in a report covering the month of July, but not in a report covering the month of June.

The GST report is separated into two sections: GST Invoiced (accrual accounting) and GST Received (cash accounting). The report has been designed this way so that users will benefit from it, whichever accounting method they use.

- GST invoiced (accrued) including the net of the totals of the following

transaction types:

- Add invoices issued

- Less claim write-offs

- Bad debt write-offs

- Discounts granted for invoices

- Refunds of allocated payments

The GST Invoiced section reports the dollar amounts of invoices where GST was involved, and the GST input for those amounts. It also takes into account, and subtracts, any write-offs or discounts that may have been applied.

- GST receipted (cash) including the net of the totals of the following transaction

types:

- Add receipt allocated to invoice items

- Credit allocated to invoice items

- Less refunds of allocated payments

Ancillary Information: Totals displayed on this report tally with the related sections of the following reports for the same date range;

- Invoice Summary

- Invoice Detail

- Invoice Detail Items

- Allocation Summary

- Allocation Detail

- Allocation Detail Items

- Income Summary

- Income Analysis

- Income Analysis Detail

- Debtors' Reconciliation